inheritance tax waiver form michigan

You still have the option to. Gifting money to a business or to a discretionary trust can create an immediate liability to tax at 20 chargeable lifetime transfers rate if you give away in excess of the inheritance tax allowance.

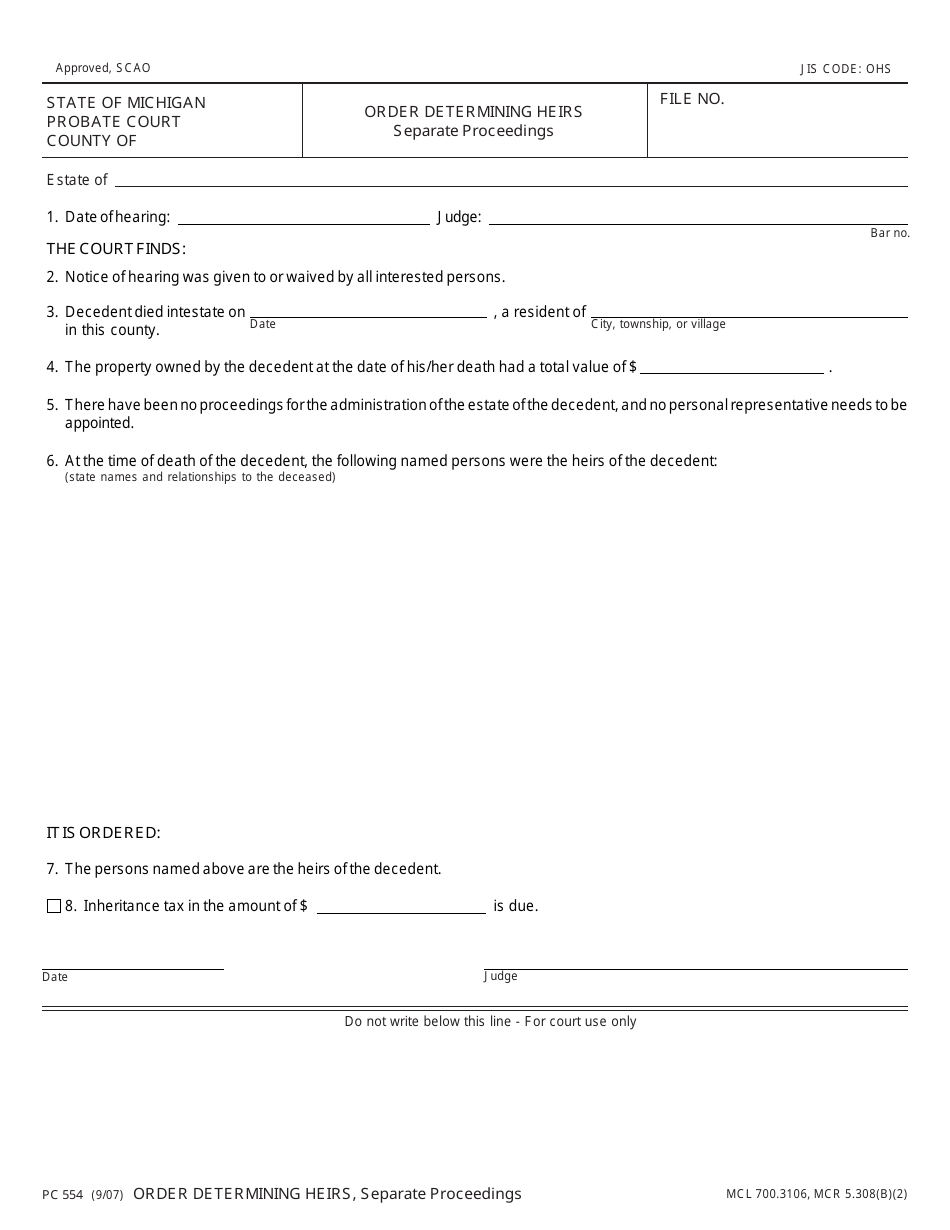

Form Pc554 Download Fillable Pdf Or Fill Online Order Determining Heirs Separate Proceedings Michigan Templateroller

Application for the Withdrawal of Filed Form 668Y Notice of Federal Tax Lien Internal.

. If you die within 7 years then inheritance tax will be paid on a reducing scale. 1826-111 - 1125 Waivers Consent to Transfer. Find out more about Michigan divorce laws including grounds for May 02 2022 5 min read.

Filing a divorce in Michigan has specific residency requirements and procedures. An option with a lower tax exposure is to have the death benefits paid over the life expectancy of the beneficiary. However most states provide various exemptions from the transfer tax such as transfers between parents and children.

The inheritance tax exemption was increased from 100000 to 250000 for certain family members effective January 1 2012. Give your assets away. The lien protects the governments interest in all your property including real estate personal property and financial assets.

If you give assets away and you survive for at least 7 years then all gifts are free and avoid inheritance tax. Get help navigating a divorce from beginning to end with advice on how to file a guide to the forms you might need and more. The tax waiver form issued by the Division releases both the Inheritance Tax and the Estate Tax lien and permits the transfer of property for both Inheritance Tax and Estate Tax purposes.

To differentiate between a domicile and a home your domicile is the state where you pay state income taxes and any estate and inheritance taxes and a state whose laws govern the enforcement of judicial. If you choose to name a charity as your beneficiary then the proceeds are free from income tax. This means that benefits will be paid out over a longer period of time.

A type of estate that only lasts for the lifetime of the beneficiary. Make sure you keep below the inheritance tax threshold. Individual Income Tax Return electronically with tax filing software to amend tax year 2019 or later Forms 1040 and 1040-SR and tax year 2021 or later Forms 1040-NR.

When congress eliminated that credit in 2005 it effectively killed Michigans estate tax. You can file Form 1040-X Amended US. Nonetheless Indianas inheritance tax was repealed retroactively to January 1 2013 in May 2013.

The transfer tax is usually a small percentage of the consideration or purchase price. A federal tax lien is the governments legal claim against your property when you neglect or fail to pay a tax debt. Estate taxes where they exist are taken out of the deceaseds estate immediately after their passing while inheritance taxes are imposed upon the deceaseds heirs after they have.

You can only have one domicile. For full details refer to NJAC. Going to a higher tax bracket means higher taxes.

Note that estate and inheritance taxes are different things. Inheritance tax is not a death tax inheritance tax is a transfer tax it a gift tax so if you give away too much away to a business or to a. See Form 1040-X Amended US.

An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations. Other taxes such as federal income gift or inheritance tax may accompany a quitclaim deed transfer. Individual Income Tax Return Frequently Asked Questions for more information.

A legal document is drawn and signed by the heir waiving rights to. The new inheritance tax allowance on property can be found here. A domicile is simply your main residence where you live all or most of the time for tax and legal purposes.

A life estate is a very restrictive type of estate that prevents the beneficiary from selling the property that. Indiana passed laws in 2012 that would have phased out its inheritance tax by 2022.

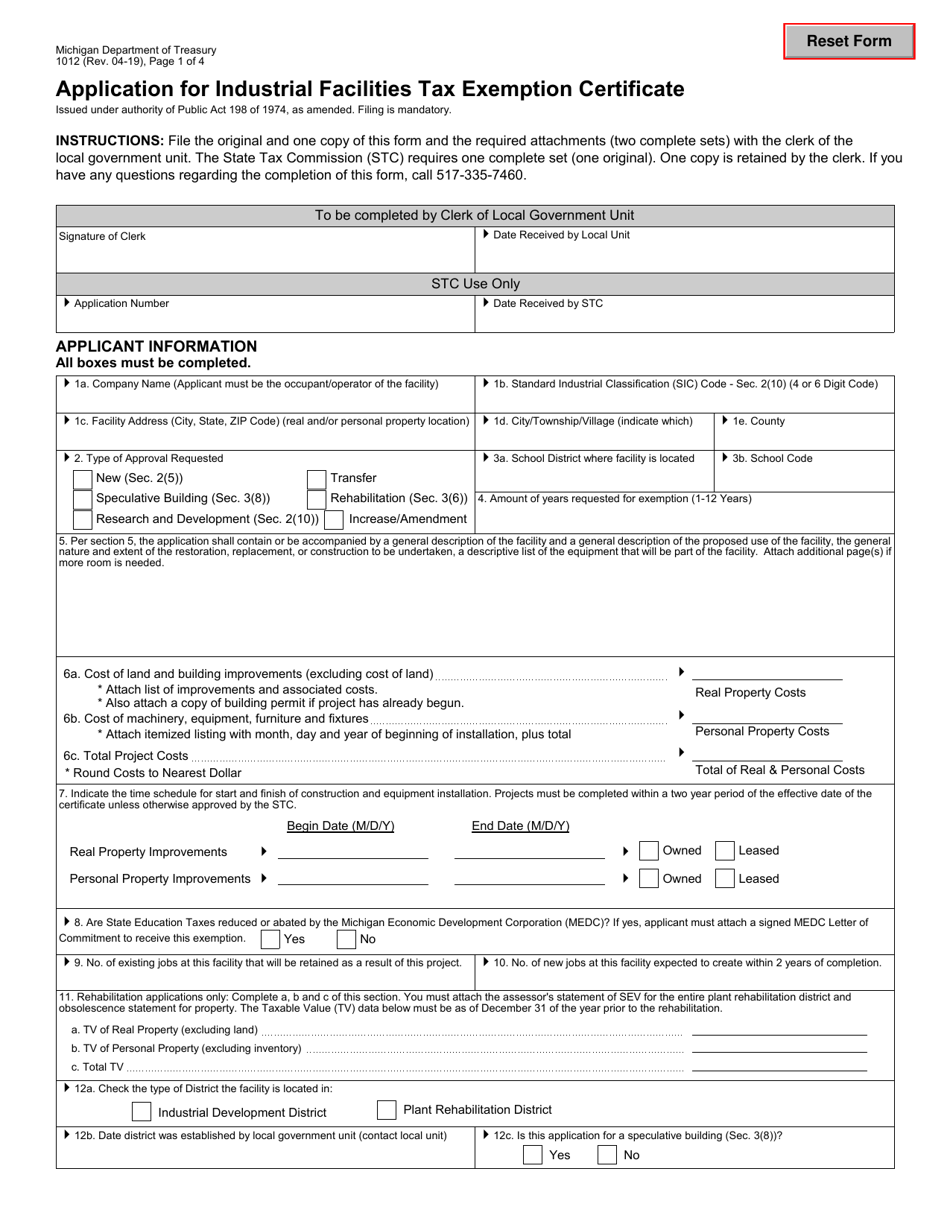

Form 1012 L 4380 Download Fillable Pdf Or Fill Online Application For Industrial Facilities Tax Exemption Certificate Michigan Templateroller

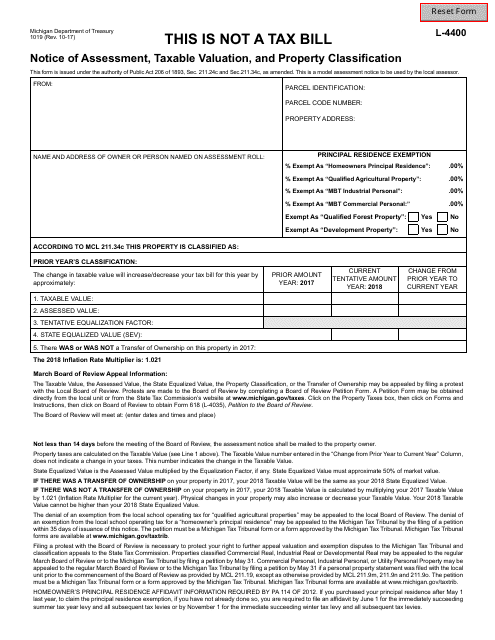

Form 1019 Download Fillable Pdf Or Fill Online Notice Of Assessment Taxable Valuation And Property Classification Michigan Templateroller

Residential Lease Agreement Download Free Printable Rental Legal Form Template Or Waiver In Different Editable Fo Being A Landlord Legal Forms Lease Agreement

Fillable Online Utoledo 08t2 Michigan Sales And Use Tax Certificate Of Exemption Do Not Send To The Department Of Treasury Utoledo Fax Email Print Pdffiller

Michigan Tax Commission Exemption Form Fill Online Printable Fillable Blank Pdffiller

Michigan Vehicle Bill Of Sale Form Download The Free Printable Basic Bill Of Sale Blank Form Template In Micro Bill Of Sale Template Templates Bill Of Sale Car

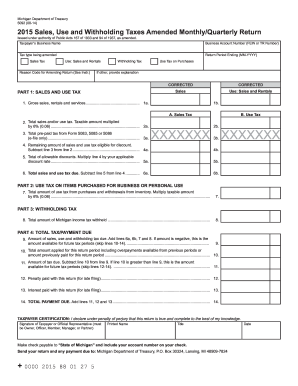

Form 5092 Michigan 2022 Fill Out And Sign Printable Pdf Template Signnow

Partial Unconditional Waiver Michigan Fill And Sign Printable Template Online Us Legal Forms

Michigan State Tax Form Fill Online Printable Fillable Blank Pdffiller

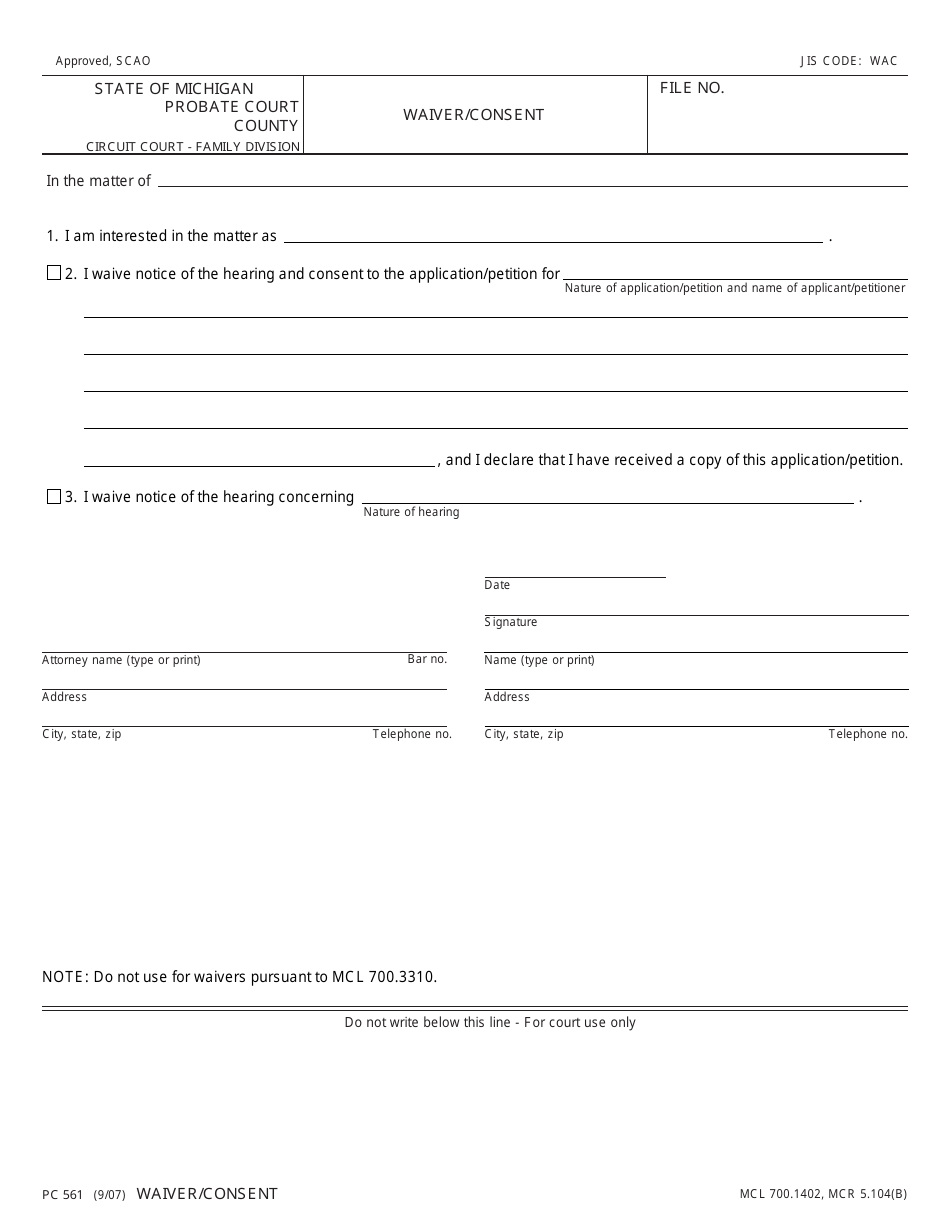

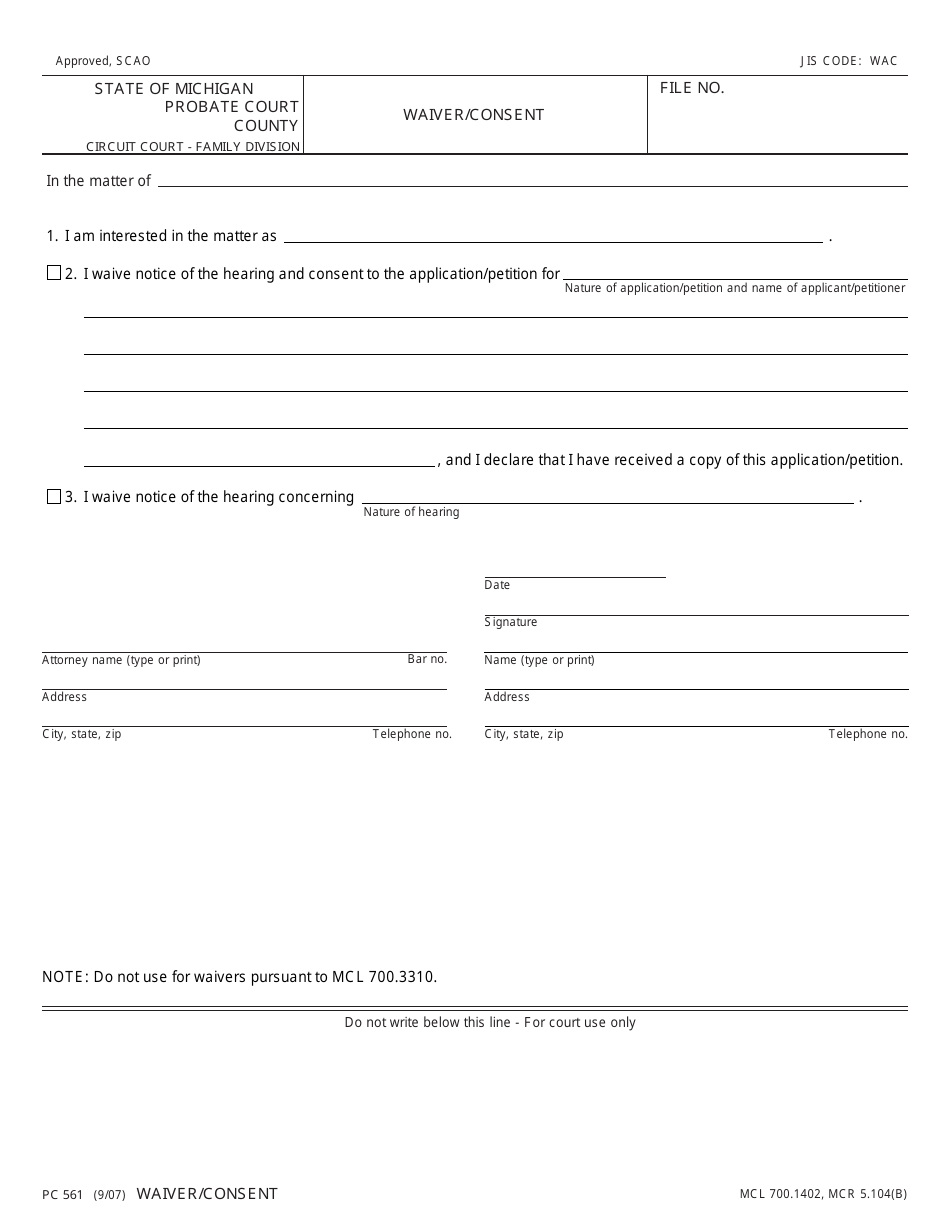

Form Pc561 Download Fillable Pdf Or Fill Online Waiver Consent Michigan Templateroller

Bill Of Sale Form Michigan Release Of Claim Of Lien Templates Fillable Printable Samples For Pdf Word Pdffiller

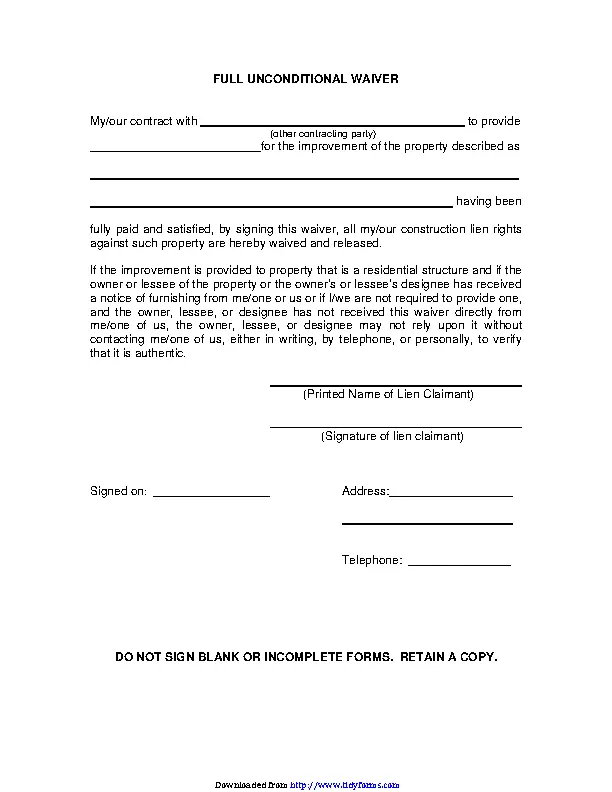

Michigan Full Unconditional Waiver Pdfsimpli

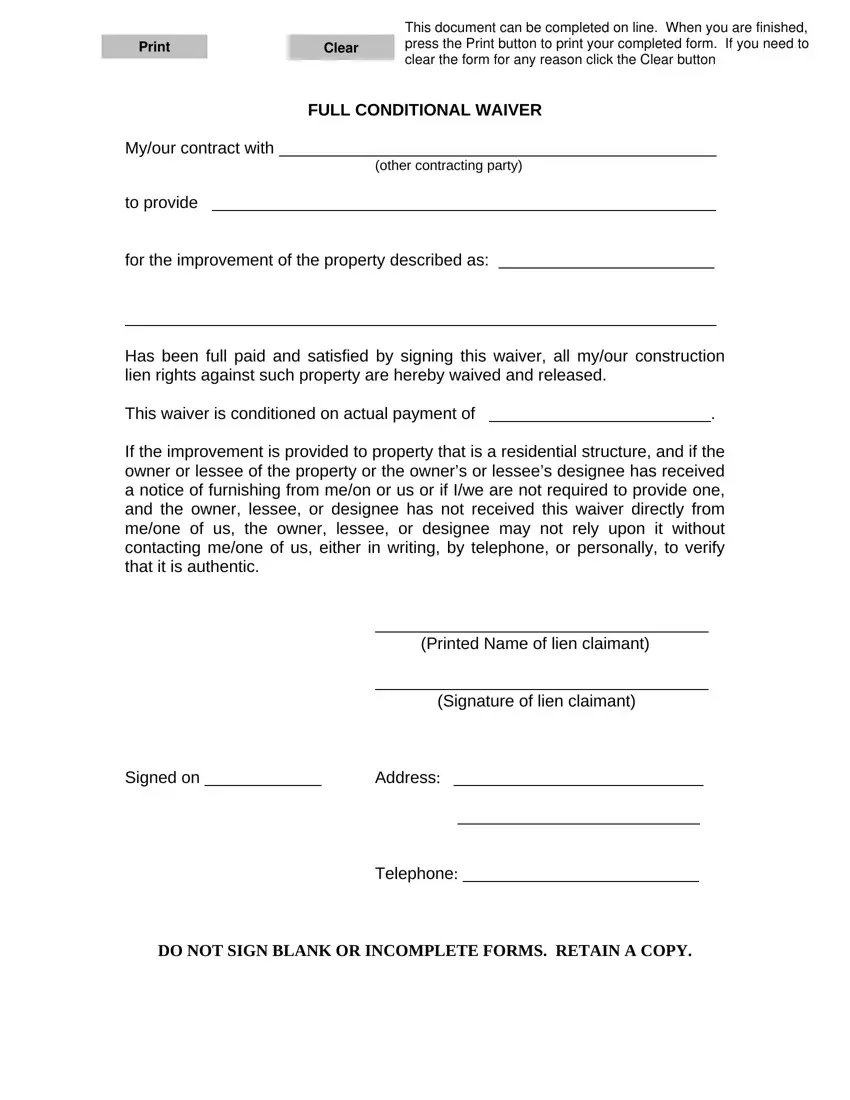

Michigan Full Conditional Waiver Fill Out Printable Pdf Forms Online

Tax Exempt Form Michigan Fill Online Printable Fillable Blank Pdffiller

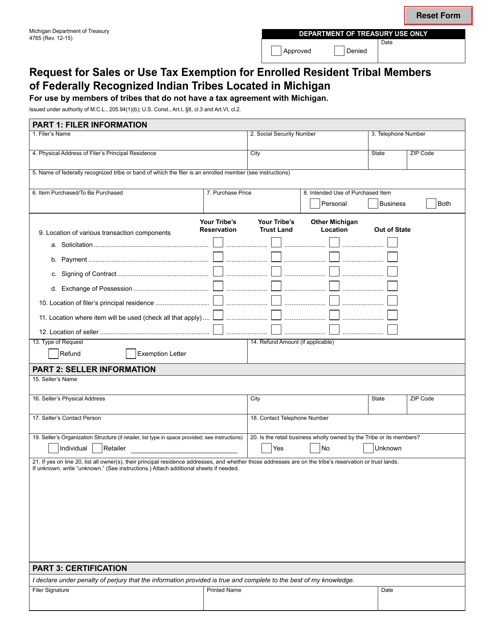

Form 4765 Download Fillable Pdf Or Fill Online Request For Sales Or Use Tax Exemption For Enrolled Resident Tribal Members Of Federally Recognized Indian Tribes Located In Michigan Michigan Templateroller

Michigan Tax Forms And Templates Pdf Download Fill And Print For Free Templateroller

Michigan Sales Tax Exemption Fill Online Printable Fillable Blank Pdffiller